Improve your working capital financing with Finalbion Factoring

Finalbion has a specialised team to finance and manage the collection of our clients' invoices.

We support the financial diversification of the company as a basis for its growth.

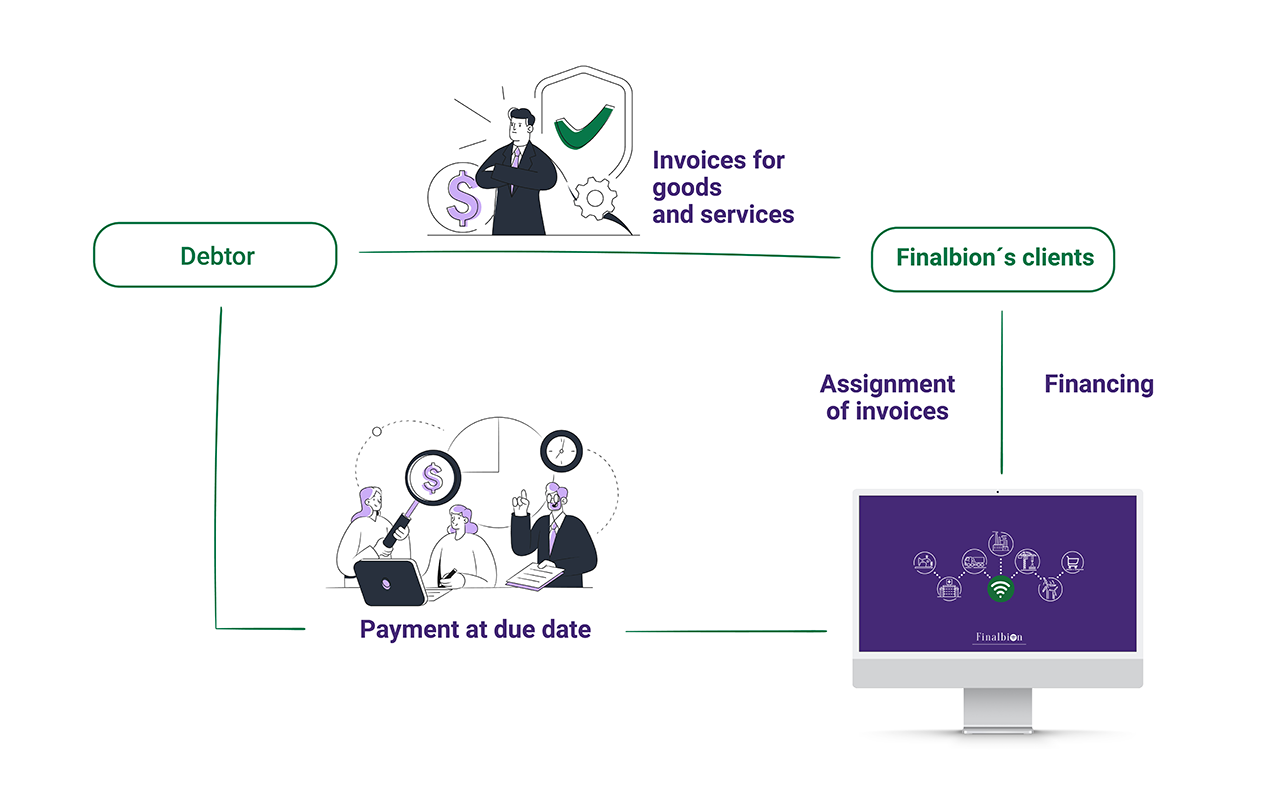

How does our Factoring work?

With Finalbion it is a quick and easy process for financing your working capital.

After studying and establishing the debtors and limits to be included in the Factoring line, Finalbion registers the contract on the platform so that our client can operate with total agility, uploading the file of invoices to be financed.

Finalbion Factoring Features

The transferor obtains immediate liquidity, improves leverage ratios and working capital.

No impact on CIRBE.

In the non-recourse factoring modality, apart from improving the efficiency of the collection management of your invoices and obtaining liquidity, the insolvency risk of the authorised debtor is covered.

Its operation is carried out through the platform, which is an online process with real-time information on the status of the line.

Diversify Factoring Lines with Finalbion

Since 2015 operating factoring

Millions financed

Financed invoices

Debtors

Frequently Asked Questions about

Factoring with Finalbion

Does the assignor have to have a specific development to operate Finalbion's business factoring?

Finalbion offers the assignor a downloadable generator from the platform to convert an Excel file into the required format in two simple steps.

Does the transferor have prior information on the financing costs?

Yes, the platform will show the exact costs of the advance payment, prior to being requested by the transferor.

Can the assignor operate several debtors on the same factoring line?

Yes, Finalbion's factoring for companies allows you to operate several debtors and to check the availability of their limit at any time.